GBP: Likely to Follow Trends in Risk Assets [stocks, commodities, AUD, NZD, CAD, EUR]

Outlook: Bearish

Summary of Past Week

- British Pound technical sell entry ahead if breaks below around 15960

- UK Consumer Confidence points to pessimism on economic conditions

- FX Sentiment points to British Pound losses against Japanese Yen

- Strong GBP correlation to risk assets could mean further declines if stocks pull in

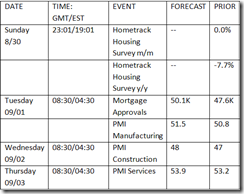

Summary Table of Coming GBP Events

Details

A lackluster week of British fundamental data made the Pound the worst performer among all G10 currencies through recent trade, and a technical break below multi-month trend line support leaves risks to the downside for the UK currency. Disappointments in GfK consumer confidence survey numbers and late-week international trade figures underlined risks to domestic consumption. A modestly positive revision to second quarter Gross Domestic Product figures failed to elicit a reaction from the UK currency, and it seems that markets had little interest in holding long-GBP exposure through illiquid trading conditions.

The week ahead should bring far more liquidity into the FX market, and it will be critical to watch the next GBPUSD moves as traders return to their desks for the first week of September.

Seasonality in global financial markets add further downside risks for the GBP, as stock markets often experience their worst month of the year through September. Indeed, the much-talked-about “September Effect” looms large on FX markets; a strong GBPUSD correlation to the US S&P 500 strongly suggests that the British Pound would lose on S&P declines. Past trends hardly guarantee future results, but we cannot ignore fairly clear seasonal tendencies. Second-tier UK economic event risk may provide some surprises, but we expect that broader financial market risk sentiment will provide the strongest influence on the risk-correlated British Pound.

Thus GBP traders should be especially alert when Friday’s US Non-farm payrolls data comes out. However, beware that the initial market reaction to NFP often reverses within the first hours.

Coming GBP Economic Events

Traders should keep an eye out for noteworthy results in upcoming Purchasing Managers Index (PMI) Manufacturing, Construction, and Services reports; the surveys are typically leading indicators for economic growth trends. All three surveys are expected to improve on the month of August. High expectations certainly leave room for disappointment and, if anything, risks remain to the downside ahead of PMI data.

Again, forex traders will keep a very close eye on end-of-week US Nonfarm Payrolls data. The infamous NFP’s report often sparks impressive, if unpredictable, moves in the US S&P 500 and US Dollar. Needless to say, any particularly sizeable surprises in the data could provide substantial GBPUSD volatility.

CHF: Likely to Follow Risk Trends to Reversal or Breakout

Outlook: Bearish

Summary of Past Week

- KOF’s leading forecast for growth is more optimistic than economists’ expectations for 2Q GDP

- German 2Q consumption and capital expenditures improve more than expected, boosting trade prospects

- USDCHF is skidding at the bottom of its well-worn range. Will the pair break or rebound?

Summary Table of Coming CHF Events

Details

The Swiss franc has seen bullish progression against most of its pairings this week. However, the few crosses that did not follow the beaten path highlight the primary fundamental drivers that surrounding the currency heading into the new week. The most prominent dissenter was CHFJPY, which weighs in on the most pressing theme underlying the franc’s progress today: risk appetite. It is this unpredictable, speculative force that has left the USDCHF locked in a 400 point range for the past three months and led broader market sentiment to flag over the past few weeks.

Turning from the yen cross to the euro pairing, our focus adjusts from speculation to fundamentals. Measured against its largest trade partner, Switzerland is so far trailing the global recovery; and the lasting damage through a somewhat protectionist agenda and the slow degradation of its banking systems legendary privacy could permanently alter the CHF’s place in the currency world.

There are deep economic shifts potentially underway and the franc is slowly losing its status as a safe haven currency; but for the immediate future, risk appetite remains the primary catalyst for direction and volatility. Through this past week, it seemed that the market was falling into a lull with liquidity thinning out for the summer.

However, the congestion and stalled trends that overwhelmed our charts is more likely a ‘calm before the storm’ scenario. The gap between fundamentals and investment activities is growing ever wider; and this reality is working its way more surely into the general consensus. To sustain a rally that is fueled by capital gains, sidelined money must continuously flow into the speculative arena. However, volume behind equities, commodities and other transparent markets shows conviction behind an ongoing bull run is flagging.

Switzerland depends on the health of the region to consume its exports. However, with the market appreciation of the franc over the past months and years, we will see a lack of demand is severely complicated by an unfavorable exchange rate that will no doubt delay a recovery that is finding woefully little support domestically.

On the topic of trade and the exchange rate, it is important to always monitor the Swissie’s place in the FX market. The sanctity of the its safe haven status is particularly important to how the market responds to the currency. The SNBs efforts at intervention produce an unwanted sense of volatility – something particularly unwelcome for a carry candidate. Going one step further, it is also considered a protectionist measure at a time when policy officials are trying to avoid such steps to facilitate a global recovery. This could isolate and perhaps further damage the currency’s reputation.

But the most concerning potential loss is the absolute privacy of the nation’s banking system. After the US successfully lobbied the government for records on American accounts, the term ‘Swiss Bank Account’ seems tarnished.

Coming CHF Economic Events

A dense round of data from the broader economic docket may spark a reconciliation between sentiment and economics. The interest rate decisions on deck (ECB and RBA) will likely show that even the most hawkish policy group is holding off on its definitive turn to rate hike. The influence of economic recovery forecasts will be in full swing. With GDP reports (Euro Zone, Australian and Canadian) and employment data (German, US and Canadian), it will be made more evident that a recovery from recession doesn’t mean we are heading straight into a strong period of expansion. The longer it takes the markets to adjust to the fact, the more dramatic the response.

It is true that risk trends hold the greatest potential for influence over the franc; but the economic docket will market its own impact through domestic channels. Top event risk is the reading of second quarter GDP. Unlike its Euro Zone counterpart, this is the first reading for Switzerland. Also, unlike its main-land peer, the Swiss economy is expected to have plunged deeper into recession through the three month period ending June. Both the forecast for a 1.0 percent contraction through the quarter and 3.0 percent pace of decline over the year would be the worst on records going back to 1980.

CAD: Pressed By Sentiment, BoC Intervention Threats, Weakening Growth

Outlook: Bearish

Summary of Prior Week

- Canadian retail sales rose 1.0% versus expectations of 0.1%

- Canada reported a record current account deficit of C$11.2 billion

Summary Table of Key CHF Events

Details

The Canadian dollar was under pressure for the majority of the week but managed to erase some of its losses as risk appetite and oil prices found support at the tail end. The CAD started the week on a positive note with June retail sales posting a 1.0% gain versus expectations of 0.1%, before fears over a limited global recovery sunk the demand for risky assets and the local currency. It was the fifth gain in six months led by a 4.7% increase in gasoline receipts. However, the second quarter current account dampened the outlook for growth as the export driven economy saw its deficit widen to a record C$11.2 billion. A C$9.3 billion drop in exports outpaced imports and led to the first traded goods deficit since 1976. The collapse in trade should lead to continued pressure on manufacturers to cut costs which will add to weakness in the labor market.

Coming CAD Events

Next week’s employment report is expected to show a rise to 8.8% in unemployment from 8.6% which would be the highest level since January, 1998. The economy is expected to have lost jobs for the ninth time in the last ten months with economists predicting a loss of 20,000 more in August.

The still declining labor market combined with sinking demand for exports will dim the outlook for domestic growth and could sink the “loonie”. However, we could see bullish Canadian dollar sentiment early in the week from the GDP report which is expected to show a 0.2% rise in June which would be the first monthly gain since July, 2008. The quarterly reading is also expected to improve to -3.0% from -5.4% as the recession shows signs of slowing. An expected improvement in the Ivey PMI manufacturing index to 54.0 from 51.8 could add to “loonie” support as the increase in activity may necessitate the hiring of new workers.

The manufacturing sector has seen job losses steadily decline and if an expansion in the sector leads to job creation then we could see the outlook for the economy brighten. Nevertheless, job creation has been the biggest concern and another month of losses may be too much for “loonie” bulls to overcome. The USDCAD appears to be carving out a range between 1.0700-1.1100 and the tug of war between signs of a recovery and limited expectations of future growth could lead to sideways price action throughout the upcoming week

AUD: Q2 GDP, RBA Interest Rate Policy Coming, But Sentiment Could Overwhelm These

Outlook: Bullish

Summary of Prior Week

- Australian Skill Vacancies rise for the first time since October 2007

- Australian 2Q Capital Expenditures Unexpectedly Increase

- Currency Market Bull Trend Stalling as Growth Forecast and Financial Stability Lose Traction

- AUD likely to be among the biggest losers if global risk appetite drops, carry trades unwind

Summary Table of Coming AUD Events

Details

The Australian dollar continued to strengthen against is currency counterparts this week and is poised to mark its longest monthly winning streak since December 1989 as investors ramp up long-term expectations for higher borrowing in the $1T economy. Credit Suisse overnight index swaps are up 191bp in August after the Reserve Bank of Australia curbed speculation for further easing, and the interest rate outlook may continue to trend higher throughout the second half of the year as the central bank anticipates economic activity to expand at an annual rate of 0.5% this year.

However, China’s State Council announced plans to limit new lending and restrict overcapacity in major industries including steel and cement after pledging to increase capital requirements for banks earlier this month, and policy makers may take further steps to ‘guide the healthy development of industries’ as the economy stands at a ‘critical period.’ The shift in government policy spurred fears of a slower global recovery as the world’s third largest economy looks to scale back on consumption, and fading demands from China, Australia’s biggest trading partner, is likely to hamper the outlook for future policy as the RBA maintains a cautious tone. At the same time, stocks in Asia/Pacific slumped throughout the week, with the Shanghai Composite index posting is fourth consecutive weekly decline, and the rise in risk aversion could temper the rally in the AUD/USD as investors weigh the outlook for a sustainable recovery. At the same time, aussie-dollar forex options have shown market sentiment has been extreme for some time, and suggests a major pull back is underway as non-commercial futures traders remain net-long on the Australian dollar, and fears of a slower return to growth paired with the rise in risk aversion could weigh on the exchange rate in the month ahead.

Coming AUD Events

Nevertheless, a Bloomberg News survey shows all of the 17 economists polled forecast the Reserve Bank of Australia to hold the benchmark interest rate at the 49-year low of 3.00% next week as economic activity improves, and commentary following the rate decision may instill an enhanced outlook for future policy as the central bank is widely anticipated to maintain a neutral policy stance throughout the second-half of the year.

Moreover, market participants project economic activity to expand for the second consecutive quarter, with economists forecasting the annual rate of growth to increase 0.7% from the previous year, and the data may drive the exchange rate higher as growth prospects improve.

However, the trade deficit is projected to widen to 880M in July from -441M in the previous month, and the slump in global trade may weigh on the outlook for future growth as exports account for more than 20% of GDP.

NZD: Likely to Trade on Risk Trends, Not Data

Outlook: Bearish

Summary

- As long as markets continue to rise, so may the Kiwi, but if they fall, it could fall hard

- Trading with risk appetite, thus US news likely to be more influential than domestic news

- New Zealand Inflation Outlook Bolsters Case for Interest Rate Cuts

- Trade Deficit Narrows as New Zealand Imports Tumble in July

Summary Table of Key NZD Events

Details

The New Zealand Dollar is likely to fall in with broad trends in risk appetite once again this week as traders look past a nearly empty economic calendar.

Coming NZD Events

While the domestic scheduled event risk is decidedly tame, the US calendar that so often serves to guide overall risk sentiment features an ample dose of market-moving releases. Most critically, the ISM survey is expected to show that manufacturing expanded for the first time since January 2008; the Fed is set to release minutes from their last policy meeting; and the all-important Non Farm Payrolls report is forecast to show the economy shed -225 jobs in August, the least in a year. If these prove to offer support to risky assets, the New Zealand Dollar will continue to advance, with a trade-weighted average of the currency’s value now 93.4% correlated with the MSCI World Stock Index.

That said, last week’s muted response to the better-than-expected US GDP revision for the second-quarter may be hinting that equities are finally feeling uneasy having reached the highest levels relative to earnings since late 2003. This make sense considering the kind of earnings and revenue growth that can be expected in a year that brings the first contraction in real global GDP since the Second World War. On balance, regardless of direction, traders are likely to continue to watch equity and commodity prices to set the Kiwi’s directional bias for the time being.

Conclusion & Suggestions

The overwhelming key point is that global risk asset markets appear overbought in light of actual growth prospects for the coming 12-24 months, and thus the next big move is likely to be down, not up. When sentiment shifts, news will be swept aside, as speculative positions in carry trades and commodities unwind, with the USD, JPY, and similar short positions against risk assets likely to be the major beneficiaries.

See Part I Conclusion for more.

Disclosure and Disclaimer: The opinions expressed herein are not necessarily those of AVA FX. The author holds positions in the above mentioned instruments.

No comments:

Post a Comment