This past Thursday saw something different, and possibly very significant—currency events influencing stocks. Specifically, a declining USD was seen as the main cause for a spike in oil prices, which in turn caused a spike in materials stocks in the US, which in turn sparked enough of a rally to lift US stocks higher despite lower results earlier in Asia and Europe.

Generally, stocks have lead currencies and commodities. Could we be seeing the start of a change in inter-market relationships, with stocks taking a less dominant role as a sinking dollar becomes more of a market moving influence of its own?

This week’s calendar is not only far busier, it should also see a spike in trading volume with the end of summer holidays. On the one hand that could minimize volatility from minor events, but on the other could mean greater movement on truly market moving news as the big volume traders get back to work.

Here’s a rundown of the key events and their possible implications.

Key Economic Events Each Day

SUNDAY August 3

Meaning: Opposition party expected to win a controlling majority for the first time since 1955. It favors taking on more debt, which could raise JPY interest rates. Short term uncertainty could weaken the Yen, but serious signs of rising rates would likely give it a short term boost.

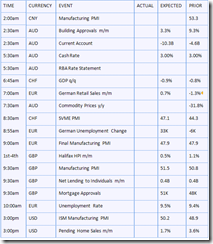

MONDAY AUGUST 31

Meaning:

- Japan: Plenty of data to help clarify its economic health

- Australia: No surprises expected

- New Zealand: the NBNZ Confidence report tends to be a good gauge of the New Zealand economy and could impact the kiwi.

- Canada: GDP is expected to return to growth, surprises in either direction could affect the CAD, US: same for the Chicago PMI and the USD

TUESDAY SEPTEMBER 1

Meaning:

- AUD: Australian Building Approvals and Current Account start the day. They will only serve as a prelude for the Australian Cash Rate, expected to remain at 3%. Fresh hints for future rate hikes might be supplied in the accompanying RBA Rate Statement.

- CHF: Swiss GDP for the second quarter is predicted to stay in the red, with and expected contraction of 0.9%. Also note Swiss SVME PMI, a survey of about 200 purchasing managers, over 50 = expansion.

- EUR: German Retail Sales are predicted to rise by 0.7% after falling last time. The more important release is the German Unemployment Change. This is important for the EUR/USD as well as for the upcoming elections in Germany this month. The all-European Unemployment Rate will also be of interest.

- UK: After a bank holiday on Monday, British data starts on Tuesday, with Manufacturing PMI which is predicted to remain above the critical 50 level and even advance. Halifax HPI, the all-important housing figure will also be published this week, probably continuing to rise.

- USD: ISM Manufacturing PMI is expected to cross the 50 mark. At the same time, Pending Home Sales are also expected to grow, following other housing figures.

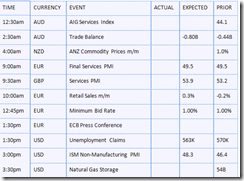

WEDNESDAY SEPTEMBER 2

Meaning

- AUD: Australian GDP, which has had only quarter of contraction in this crisis, is predicted to continue growing, this time by 0.6%.

- GBP: British Construction PMI is another important housing figure. It’s predicted to remain below 50.

- EUR: European Revised GDP is expected to confirm the small contraction at 0.1%. A surprising growth figure will definitely boost EUR/USD.

- USD:

- ADP Non-Farm Employment Change, the preliminary release for Friday’s Non-Farm Payrolls (NFP), is expected to show less job losses, at 250K. This isn’t always a good prediction for the NFP.

- Dennis Lockhart, who said last week that the real unemployment rate in the US is 16%, will speak again today, and might shake the markets. More important news from the Fed will come with the FOMC Meeting Minutes. In their last meeting, the only news was that they were slowing the bond buying program, or spending fewer dollars.

THURSDAY SEPTEMBER 3

Meaning

- AUD: Australia will start the day again, with Trade Balance which is expected to deepen.

- GBP: British Services PMI is expected to remain above 50 for the fourth consecutive month.

- EUR: European Retail Sales are predicted to turn positive this time, but the markets will be anticipating a bigger release from Europe.

Jean-Claude Trichet and co. will be releasing the new Minimum Bid Rate at 11:45 GMT. It’s predicted to remain at 1%. Hints about possible rate hikes aren’t expected at the ECB Press Conference, since Europe is suffering from deflation.

- USD: American Unemployment Claims were very disappointing in the last weeks. They’re expected to edge upwards, giving us another minor prelude to the NFP.

- ISM Non-Manufacturing PMI, the complementary figure for Tuesday’s ISM Manufacturing PMI is expected to remain under 50, still contracting. The road to recovery is narrow.

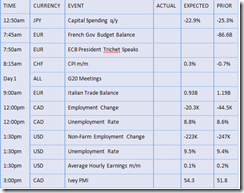

FRIDAY SEPTEMBER 4

Meaning

- EUR: In the wake of the G20 meetings, Jean-Claude Trichet will speak again. Finance ministers and central bankers start two day meetings today, and their statements will influence the markets.

- CAD: Before the US NFP, Canada will also release employment data: Canadian Employment Change is predicted to fall by 20K, while the Unemployment Rate is predicted to rise to 8.8%. Later in Canada, Ivey PMI is expected to jump up.

- US: Non-Farm Payrolls are expected to fall by 223K.If these expectations are met, it’ll be the best result since the crisis broke out. Unemployment Rate, which surprised by falling last time, is expected to edge back up to 9.5%. Considering that many have discounted the falling unemployment rate as more of a negative sign, specifically of long term unemployed exhausting their benefits and falling further into poverty, anything but a major upside surprise may not have much effect. The NFP report is arguably the most market-moving event of the week, and as the last two readings show, possibly of the month. However, its significance depends to some degree how much the prior news of the week has already clarified the picture of US and global economic health, as well as whether this provides any major surprise from the expected result.

Conclusion & Suggestions

TRADING OPPORTUNITIES: Each of the three are real possibilities:

· Play the Pullback: Stocks and other risk assets are at highs, the USD deeply shorted against the AUD, NZD, CAD and EUR. Traders should be ready with a plan to play a reversal of this trend when key calendar events (see above) hit this week or if stocks moves down. Specifically, this means be ready to short stock indexes, commodities, and commodity/high yield currencies, and go long the JPY, USD, CHF (in that order) against other currencies.

o For currency traders, possible pairs to short in that case could be: AUD/USD, JPY/USD, NZD/USD, or long USD/CAD. To play these via ETFs: short (FXA, FXC, FXE), (UUP), (DBV). Long (UDN), (FXY), (FXF). See prior analyses for info on why markets remain overbought, overpriced, vulnerable to pullback.

o For stock index traders, short the major global indexes. Via ETFs, short (SPY), long (SDS). Commodity traders would short gold, crude, etc. Via ETFs, short (GLD). Still looking for a good oil ETF. Better to use CFDs for oil.

· Play the Up Trend: However, markets continue to focus on the positive and could continue up as long as no major news contradicts ongoing recovery story or questions current risk asset prices. Continuing low interest rates and upward stock momentum a plus for risk assets. Trade the opposite of the above.

· Play the Trading Range: If news fails to surprise, markets could well stay in flat trading range.

Note: Always use stop loss orders.

Disclosure and Disclaimer: The opinions expressed herein are not necessarily those of AVA FX. The author holds positions in the above mentioned instruments.

No comments:

Post a Comment