Prior Week Recap

FXThe USD continued to move opposite of stocks, thus stocks rising to new highs caused the USD to hit new lows, which in turn triggered a sharp rally across the forex market with currency pairs such as the EUR/USD, AUD/USD and NZD/USD hitting 12 month highs on a near daily basis. For the EUR/USD and NZD/USD, it was the longest streak of gains since March.

However it is rare to see a trend this strong without a correction and judging from the latest price action in the forex and equity markets, a deeper correction may be in store for the coming week. It is important to realize that a 2 percent sell-off in the majors would still be needed to break the uptrend.

FX Moving More With USD Weakness Rather Than Rising Risk Appetite

Although some people may have credited the sell-off in the U.S. dollar to the improvement in risk appetite, we believe that it has been a story about the dollar and not risk because of the corresponding weakness in USD/JPY. If these movements were part of a broader risk appetite theme, then the USD should have gained against the JPY.

STOCKS - The Power of Postive Thinking-Nothing More

No strong fundamental reasons for continued rally, considering

The rather tepid growth projected for the coming year was supposed to be priced in

Average PE for the S&P is above average, 17 at best, far higher at worst estimates, and we are in a far below average period in which most “good” economic news is some variant on “less decline than expected” - an apt summary of most of Q2 earnings season and most recent economic data.

Banking, housing , and employment weakness , the root of the current crisis, are still awful and as likely to get worse before they get better.

Trading volume less the high frequency trading in a few stocks is very low

ETC... See past posts for more reasons I just don't believe in this rally.

Nonetheless, the stocks and other risk assets remain in uptrend, facts be damned.

Stock market participants drove the S&P 500 up 2.6% during the holiday shortened week, with gains seen on three of the four sessions, and the benchmark index hitting fresh highs for 2009. Buying interest was broad-based, with nine of the ten sectors posting gains

In economic news, weekly jobless claims fell to 26,000 to 550,000, topping the 560,000 consensus. Although the beat was welcome, the claims still remain at elevated levels and will result in the unemployment rate ticking upward. Continuing claims declined 159,000 to 6.088 million. The consensus expected continuing claims to decline a more modest 34,000. But the drop in continuing claims is not due to a decrease in jobless workers -- rather workers are running out of unemployment benefits.

The Fed's Beige Book, a collection of anecdotal economic data from the Fed districts, continued to show that the rate of economic decline is slowing, with manufacturing showing improvement. But areas such as employment, consumer spending, and construction remain weak.

In other news, Treasury Secretary Geithner aided stocks during his testimony before congress. He said that policymakers are in a position to evolve their strategy with the goal of repairing and rebuilding the economy's foundation for future growth. Geithner also said that it is unlikely more bank bailout money will be needed, so its contingency provision can be removed from the budget.

COMMODITIES

OIL

Oil rallied on news that OPEC is keeping its output unchanged, IEA raised its demand forecast and weekly inventories showed an unexpected decline. Crude settled the week up only +1.8%, however, after giving up more than 3% on Friday.

GOLD

Meanwhile gold held its gains from the prior week, and settled at $1006.70, crossing the $1000 mark for the first time since February. Many now claim the huge gold rally last week was sparked by miner Barrick buying back hedges, suggesting optimism about gold's continued trend up. Perhaps, but remember, Barrick was the same one that made these bad hedges in the first place, so we question their predictive abilities. We also suspect gold could well see more upside over the coming year, though we believe the trend will be far from straight up.

The Coming Week’s Events & Implications

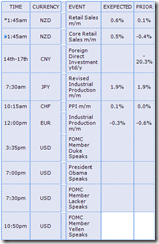

This week is loaded with rate decisions, CPI and retail sales results from around the globe.Here’s a quick look at the major coming weeks events and likely implications

NOTE: ALL TIMES ARE GMT, * = KEY IMPORTANCE

MONDAY SEPT 14TH

For kiwi traders, the week begins very early, on Sunday at 22:45 GMT with Retail Sales with are expected to rise. It's the primary gauge of consumer spending, which accounts for a majority of overall economic activity

Swiss PPI is published in the morning and is expected to remain stable. European Industrial Production is predicted to drop again, this time by 0.4%. This is the main EUR event of the day. It tends to have a relatively mild impact because Germany and France, which account for about half of the Eurozone's economy, release earlier production data.

However, since these two are already assumed to me on the mend, surprises in either direction for the weaker half of the EZ could move the EUR, and thus the USD. It's relevant as a leading indicator of economic health - production reacts quickly to ups and downs in the business cycle and is correlated with consumer conditions such as employment levels and earnings;

Near the end of the day, British RICS House Price Balance is expected to fall by 0.1% (delayed from last week).

TUESDAY SEPT 15TH

Australia starts the day with Monetary Policy Meeting Minutes and Housing Starts which are expected to turn positive.

British prices are expected to show a smaller rise. Following the CPI, Inflation Report Hearings will also shed some light on British inflation.

In Germany, the ZEW Economic Sentiment is expected to continue rising, pushing EUR/USD higher

American Retail Sales (and Core Retail Sales) are expected to turn positive. Also price reflected in the PPI, carry high expectations.

Also note the Empire State Manufacturing Index, Business Inventories and Ben Bernanke’s the all-important speech about the crisis.

WEDNESDAY SEPT 9TH

Australia’s MI Leading Index starts the day down under.

Swiss Retail Sales are on the rise, and will probably do it again, this time by 1.1%. Swiss ZEW Economic Expectations will follow.

British Claimant Count Change is the first and foremost employment figure. It’s expected to remain stable. British Unemployment Rate is predicted to rise to 8%. Will GBP/USD stay behind on this as well?

European CPI isn’t expected to signal the end of deflation: it’s expected to fall again.

American CPI is expected to be different, and rise by 0.4% after falling last time. Core CPI is also expected to edge upwards.

TIC Long-Term Purchases, representing the cash flow in and out of the US, are expected to squeeze to 60 billion. This data represents the balance of domestic and foreign investment - for example, if foreigners purchased $100 billion in US stocks and bonds, and the US purchased $30 billion in foreign stocks and bonds, the net reading would be 70.0B. The market impact tends to be significant but varies from month to month.

Also in the US, Current Account, Capacity Utilization Rate and Industrial Production which is expected to rise by 0.5%.

Japan’s Tertiary Industry Activity is expected to continue rising, this time by 0.6%. Also not the Japanese BSI Manufacturing Index.

THURSDAY SEPT 17TH

As the calendar suggests, the busiest day of a busy week.

No change is expected in the Japanese Overnight Call Rate, expected to remain at 0.1%. The focus will turn to the Monetary Policy Statement and the accompanying BOJ Press Conference.

British Retail Sales are predicted to rise by 0.5%, following last month’s rise. Also note CBI Industrial Order Expectations, which are still very low.

It’s Canada’s turn for the CPI release. Core CPI and CPI have been weak. Canada also releases leading indicators. Sounds important, but because most have already been released this figure doesn't tend to move markets.

Switzerland’s quarterly rate decision is due. The Libor Rate is expected to stay at 0.25%. The SNB hasn’t hesitated to intervene in the markets. Will they do it again? We’ll know at the SNB Monetary Policy Assessment. USD/CHF is not far from parity.

In the US, Building Permits are expected to rise to 580K. Housing Starts are predicted to rise to 590K. American housing is off the bottom.

Unemployment Claims, which made a surprise last week, are expected to rise back to 562K. Also note the Philly Fed Manufacturing Index which is expected to rise to 8.1 points.

Friday Sept 14th

German PPI is expected to rise by 0.1%, after posting a big drop last time. European Current Account is predicted to show a smaller deficit this time.

British Public Sector Net Borrowing is expected to grow, showing that the government lends more money.

Canadian Wholesale Sales close the week.

See Part II for more on the coming week’s outlook for specific currency pairs, commodities, and stock indexes.

Disclosure and Disclaimer: The views expressed to not necessarily represent those of AVAFX. The author has positions in the above instruments

No comments:

Post a Comment