Prior Week Recap

Despite a variety of potentially market moving events like PMI reports, central bank statements, and the always potent US non farms payroll report, most currencies stayed within multi-month trading ranges. Only the AUD/USD broke out.This makes sense, since none of the news changed the prevailing consensus: barring an unforeseen new disaster, that global risk asset markets (stocks, commodities, and risk currencies) have the worst behind them and should at least hold steady and eventually begin to rise.

Our view is less optimistic, and we see plenty of evidence to suspect another major dive with the year, but that’s another discussion.

Interpreting the Non Farms Payroll Results

As usual, non-farm payrolls sparked plenty of volatility in the fore market. The knee jerk sell-off in the dollar was quickly cancelled out, giving us the typical V shaped bounce of the EUR/USD reaction to payrolls. For the 20th month in a row, the U.S. economy had negative job growth, but the pace of layoffs has eased considerable. Non-farm payrolls fell by 216k in August, the fewest in the past 12 months (we had highs over 700k). This was better than the market had anticipated because the expectations were for a drop of 230k. The July data was revised only modestly lower from -247k to -276k. The big surprise was in the unemployment rate which rose to 9.7 percent the highest level since June 1983. The dollar sold off aggressively when traders saw the unemployment rate print because the market had only anticipated a rise to 9.5 percent.However there is no question that the markets see the slowing job losses as overall improvement, which has brought relief to the currency market and helped the dollar recover its gains after traders realized that the report was not that bad. With the initial post payroll volatility settling and the holiday weekend looming, the dollar is likely to onto its gains in the coming days.

Yet because companies are not firing as aggressively does not mean that the labor market has really improved. Friday’s household survey confirmed that unemployment rate remains painfully high. U.S. officials have also warned that the unemployment rate could rise even as the labor market and the economy improves. This report is right in line with the Federal Reserve's expectations and will therefore not alter their plans for exit.

Understanding the Difference Between NFP and Jobless Rate

The NFP report gives us a more comprehensive look at the labor market because it gathers data directly from 400,000 companies whereas the Household survey which gives us the unemployment rate only surveys 60,000 households. Part of the divergence between these two surveys comes from the possibility that the household survey includes people who may have been self employed or working off the books. Based upon Friday’s report, those people are losing their jobs.The manufacturing sector also saw the 21st consecutive month of negative job growth but one good thing is that average hourly earnings have increased.

When Will the U.S. Labor Market Return to Growth?

According analyst Kathy Lien, the behavior of non-farm payrolls continues to be similar to that of the 1980s (as indicated in the chart below). Assuming that this correlation continues, we could see positive job growth by the first quarter of next year if not sooner. Monster.com has already reported an increase in online job advertisements which is a step in the right direction.The Coming Week’s Events & Implications

The coming week is a bit quieter than last week, given that:· Monday Labor Day holiday takes out most of the US and Canada trading

· There are few major events for the more volatile of the major currencies, with much of the emphasis on AUD,NZD, and CAD events. These currencies are already in established trends and tend to be more influenced by overall sentiment than local economic news

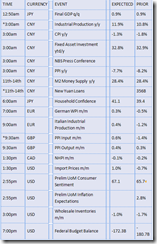

Here’s a quick look at the major coming weeks events and likely implications

NOTE: ALL TIMES ARE GMT, * = KEY IMPORTANCE

MONDAY SEPT 7TH

With both the US and Canada off for Labor Day, low liquidity trading. Combined with the lack of big news, Monday is likely to be a quieter day. The only major item is for the GBP, with the Halifax home prices survey. For the EUR, investor confidence and steady-to-improving manufacturing may already be priced in, thus the Sentix Investor Confidence and German Factory orders data may only be of interest if very surprising in either direction.

TUESDAY SEPT 8TH

GBP retail and house price data, along with AUD business confidence start the early part of the trading news day, but the biggest morning news is likely to be GBP Manufacturing Production, followed soon after by German Manufacturing data, which is expected to turn positive. Germany has been the top Euro zone performer of late. The other major data will likely be CAD Building Permits, also expected to improve. Traders however, must balance good news against the BoC’s threats to restrain CAD appreciation. These could become more serious if the CAD makes major further advances against the USD. American trade accounts for about 75% of Canadian exports.

Fighting central banks can be dangerous, as CHF traders found out earlier this year.

WEDNESDAY SEPT 9TH

A big day for the AUD and NZD pairs, with plenty of news that might move the related pairs if they generate surprises. Also German Final CPI will be worth watching to confirm whether German prices actually rose. Deflation has been a concern in the Euro zone, so we’re in a rare period in which some inflation is not considered negative.

Moving west, Canadian housing starts should show modest improvement after last month’s disappointments, and the important US Beige Book gives a broad view of economic health and may clarify if the extent of US recovery, if any. Recent data suggests business is improving but jobs, the key for a consumer spending driven economy, are not. As long as jobs do not recovery, the entire recovery remains in doubt, as weak spending will continue to undermine still fragile improvement in business and the financial sector.

The day ends with New Zealand Central bank data and further clues on interest rates. Some expect a lowering of interest rates, which would spark some bearish NZD action, especially given how high the NZD has risen and the amount of long NZD carry trades.

THURSDAY SEPT 10TH

The day begins with Australian employment figures: Employment Change is predicted to fall by 14.7K, and the Unemployment Rate is predicted to rise from 5.8% to 5.9%.

In keeping with recent trends, French Industrial Production is expected to rise. Also France, like Germany, is ahead of the continent in recovery. Later, the ECB Monthly Bulletin will be of interest to EUR/USD traders.

The day is full of Chinese data, from which we’ve come to expect good things. Beware, however, that the Chinese have shaken global markets with their warnings to reduce lending and thus cool Chinese growth, which has become a pillar of world recovery hopes. Thus not only industrial production, but lending data could be very important, especially for the JPY and AUD, if these bring any surprises.

The British interest rate isn’t expected to move from the historic low of 0.5%. However, after the surprising expansion of the Quantitative Easing program last month, the BoE could surprise again. The Pound could be volatile around the time of the MPC Rate Statement.

At 12:30 GMT, there’s the American Trade Balance, expected to show a deficit of 26.8 billion, and also the Canadian balance, which is predicted to be nearly balanced as strong crude prices do their part.

Half an hour later, Canadian interest rate will be published. Also here, the ultra low Overnight Rate of 0.25% isn’t expected to be changed – not any time soon. Traders will listen to the BOC Rate Statement, which might hint about the economy, but is not likely to give clues about rate hikes.

As usual, crude inventories assume importance only if there are questions about crude prices – or if this report surprises the markets enough to create such questions.

In the aftermath of the Non-Farm Payrolls, American Unemployment Claims are expected to ease to 555K. After numerous disappointments from this figure, we don’t expect a positive surprise.

Speeches by Timothy Geithner, Dennis Lockhart and Donald Kohn will also move the greenback today.

Near midnight GMT, Japan’s Final GDP is predicted to confirm the second quarter growth of 0.9%.

Friday Sept 10th

British PPI Input fell last time, and is now expected to rise by 0.6%. Deflation is a concern for the UK, so disappointment here could pressure the GBP.

In the US, Import Prices are expected to rise by 1% after falling last time. Preliminary UoM Consumer Sentiment is also expected to be on the rise and reach 67.1 points. However, consumer spending has not kept pace with improvements in sentiment, making this figure less significant

Near the end of the day, the Federal Budget Balance is released, and is expected to show a deficit of “only” 172 billion.

See Part II for more on the coming week’s outlook for specific currency pairs, commodities, and stock indexes

Disclosure and Disclaimer: The views expressed to not necessarily represent those of AVAFX. The author has positions in the above instruments

No comments:

Post a Comment